- Published on

Time in the Market

Time In The Market and Expected Loss

Warren Buffett's timeless statement, "Time in the Market always beats Timing the Market," prompts reflection on its veracity.

The realm of stock trading inherently carries risk, leading to contemplation regarding the mitigation of market exposure. However, our research reveals a contrary trend. Over extended periods, equities demonstrate a consistent upward trajectory, surpassing inflationary pressures.

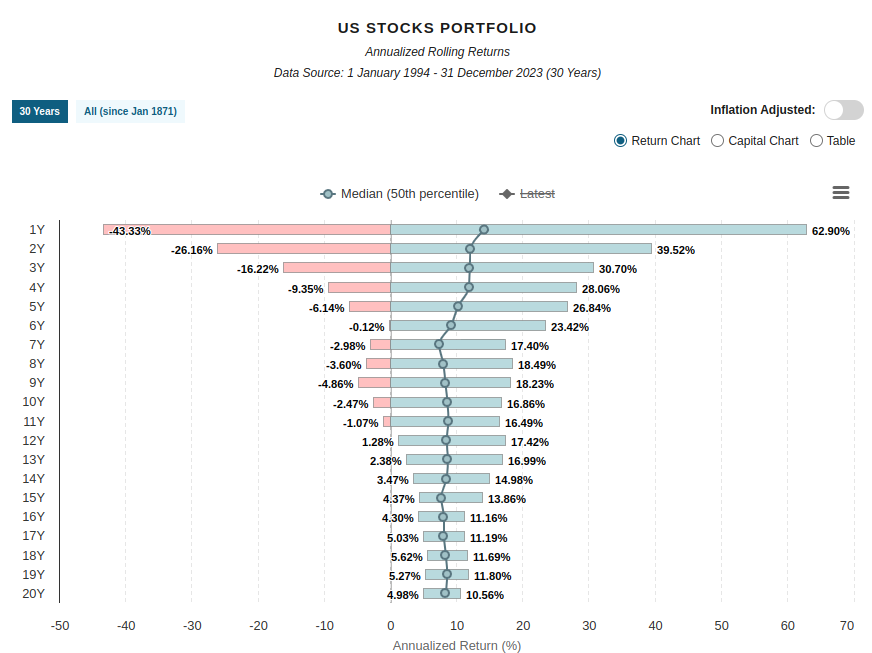

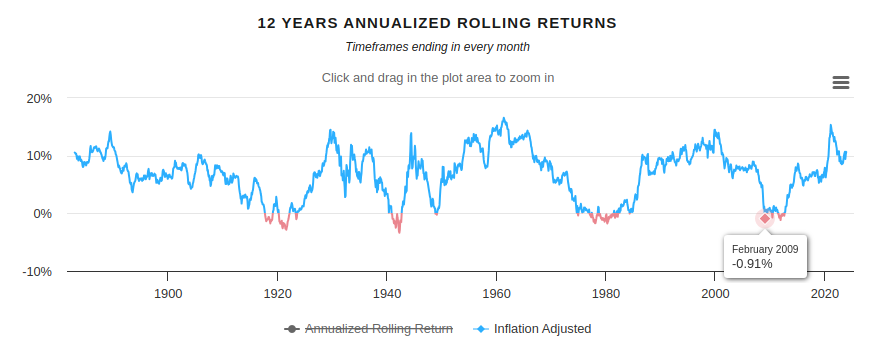

A comprehensive analysis, as portrayed by LazyPortfolioEtf.com, presents compelling graphical depictions:

This graph shows the correlation between the duration of investment and the anticipated range of percentage gains and losses, drawing upon a century of historical data. Notably, it accentuates the diminishing likelihood of loss with prolonged holding of US equities. It's noteworthy that equities exhibit resilience amidst economic downturns, albeit contingent on a holding period exceeding 12 years.

This data underscores the success of a "buy and hold (potentially forever)" strategy, albeit acknowledging the potential necessity for extended waiting periods in the absence of favorable circumstances.

Maybe we can improve our odds by timing the market?

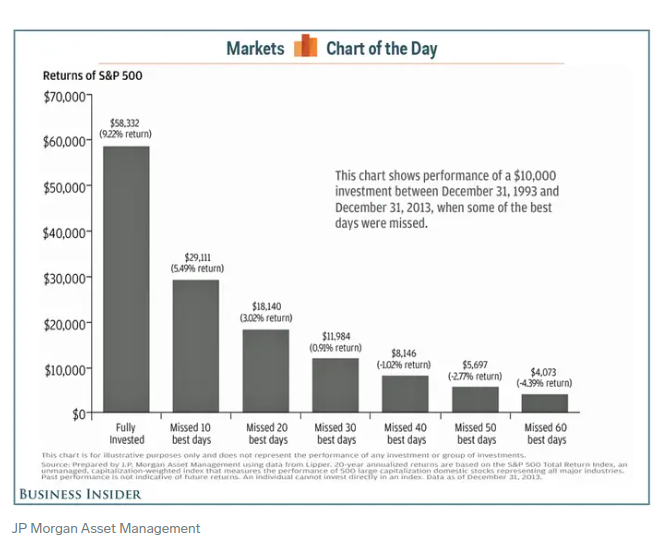

Instead of delving into strategies for timing the market, let's have a look at another statistic that has been procured by JPMorgan. The following graph showcases the frequency of significant upward or downward market movements and the ramifications of missing such occurrences.

This visualization indicates that the majority of market gains manifest in a select few events annually. While not dismissing the feasibility of market timing, it underscores the costly implications of missing these pivotal market movements. Additionally, it invites consideration regarding the resource-intensive nature of identifying highly profitable market days and the associated risks.

Concluding Insights

While refraining from an exhaustive exploration of market timing strategies, several guiding principles merit consideration:

- Acquire stocks with a willingness to retain them for potentially over 12 years.

- If pursuing market timing, align acquisitions with the overall market direction.

- Deliberate on placing orders at predetermined prices or dates instead of impulsive purchases.

- Explore the potential efficiency of employing simple dollar-cost averaging techniques as highlighted here .

These principles provide a foundation for informed decision-making amid the complexities of market dynamics.