- Published on

Growth vs. Dividend Stocks

The dichotomy between growth and dividend stocks often presents investors with contrasting investment philosophies, each with distinct appeals and risk profiles. Delving into each category sheds light on their intrinsic characteristics.

Growth Stock

Renowned for their promising future resale value, growth stocks exemplify significant volatility and upward potential. Frequently, these stocks represent technology enterprises pioneering market-disrupting innovations. However, evaluating these companies proves challenging due to multifaceted success determinants, often lacking predictable revenue streams or profitability. While celebrated success stories like Meta, Amazon, and Tesla dominate headlines, numerous other ventures falter in this domain.

In today's landscape shaped by AI revolutions and a high-interest economy, several factors contribute to the potential failure of these enterprises:

Inability to find a product-market fit Challenges in scaling and productionizing products Struggles in securing additional funding Inability to render services at a profitable price point, exacerbated by cost-of-living crises Speculative investor anticipation of future earnings often reflects in soaring Price/Earnings ratios, evident in examples like AMD's P/E ratio exceeding $1000 per share.

Notable Performances in Growth Stocks (source):

| Ticker | Name | 1 Year Return | Revenue Growth |

|---|---|---|---|

| VRT | Vertiv Holdings Co | 215.20% | 13.87% |

| META | Meta Platforms Inc | 177.10% | -1.12% |

| NVDA | NVIDIA Corp | 176.40% | 0.22% |

| MDB | MongoDB Inc | 172.30% | 46.95% |

| PLTR | Palantir Technologies Inc | 167.30% | 23.61% |

| APP | AppLovin Corp | 160.00% | 0.86% |

| DKNG | DraftKings Inc | 149.50% | 72.87% |

| SPOT | Spotify Technology SA | 133.10% | 8.11% |

| CRWD | CrowdStrike Holdings Inc | 101.40% | 54.40% |

| SPLK | Splunk Inc | 95.10% | 36.66% |

Dividend Stock

In stark contrast, dividend stocks typically represent well-established entities with robust fundamentals. These businesses, usually conservative in reinvesting profits, exhibit modest growth while distributing earnings to shareholders through dividends. Predominantly found in financial services, telecommunications infrastructure, or Real Estate Investment Trusts (REITs), these stocks are revered for stability.

However, dividend stocks aren't devoid of risks, nor do they guarantee dividends. For instance, REITs might face losses due to tenant defaults, while service-oriented firms could face obsolescence with emerging disruptive technologies.

Furthermore, the impact of dividends on stock valuation remains a nuanced consideration, as dividend payouts are discounted from the stock price. Many dividend stocks exhibit resilience, promoting long-term holding or dividend capturing strategies.

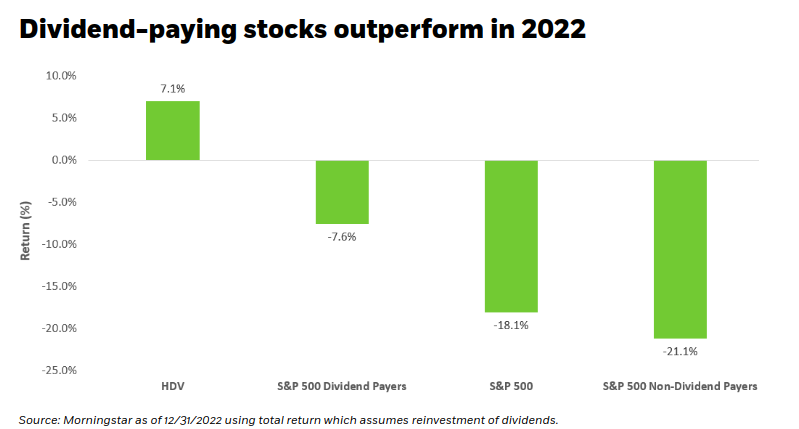

The resiliance was proven during 2022 where the iShares Dividend ETFs showed great performance (source)

It is also worth mentioning that dividend payouts compared to capital gains from selling stocks have beneficial treatment in some countries.

Concluding Thoughts

Comparing profit realization methods in growth and dividend stocks emphasizes their divergent nature:

Growth Stocks: Profit is harvested by selling shares at higher prices, offering investors discretion in timing.

Dividend Stocks: Profits are received through periodic payouts, with timing determined by the company. The differing risk profiles of these stocks can be summarized as:

Growth Stocks: Show high volatility but promise higher growth potential.

Dividend Stocks: Offer reliability but often underperform in overall earning potential compared to growth stocks.